As we discussed in what may be our most viewed Dataspace blog post (ever!), insurance is one of the oldest data science based businesses – using math to make predictions about the future.

In today\’s post, we’ll be highlighting some ways in which data science has infiltrated, influenced, and innovated the insurance industry! There are lessons here even if you\’re not in insurance.. so read on!

We know a thing or two because we’ve seen a thing or two!

A thing or two, or two million! A new world of Big Data has many implications for the world of insurance. This article addresses an example or two. 🙂

Be protected from mayhem!

Similarly, the concepts and methods of Big Data analytics have inspired many changes in the process of risk prediction.

Fifteen minutes could save you 15%

When selling to a new generation of customers with expectations for one-click shopping, the industry has also had to specifically focus on adapting to a competitive environment of on-demand insurance.

Safe drivers save 40%

Ten years ago it would have been unimaginable that a device in your car or on your wrist tracking your behavior could affect your insurance rates. As our technical capabilities increase, a conscious effort to support innovation is helping the insurance industry keep pace with the ever changing tech world.

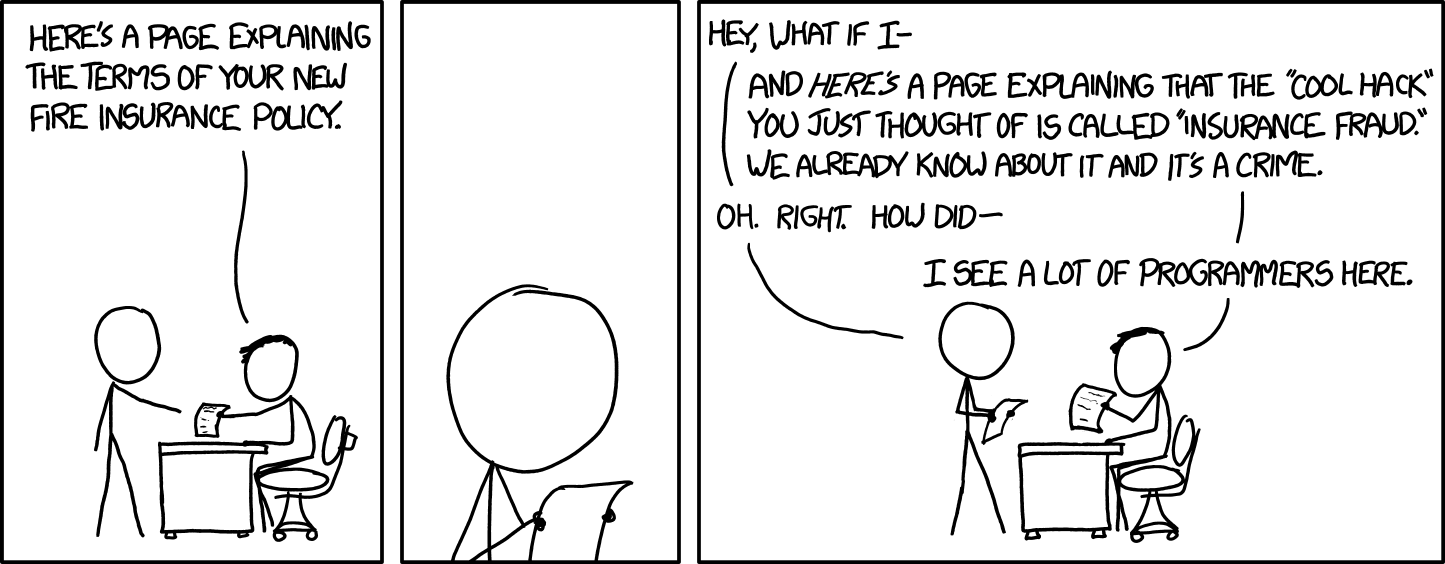

Clearly, even in an industry as established as insurance, the world of data science and Big Data will continue to open up possibilities for “cool new hacks” that both improve customer experience as well as provide better insights into risk prediction.

Ben’s Take

One of the first things people find out about me is that, before moving full time into data issues, I was a CPA. Now, I am a recovering CPA. My first job out of college was with Deloitte, Haskins, and Sells, one of the big eight accounting firms (yes, there were eight), and the first client I worked with was a large insurer (actually, a reinsurer, to be precise). It quickly became apparent to me that, while most people think of insurance as boring, it’s actually a fascinating business! For example, in most industries, you largely know what you owe people (i.e. your liabilities): I bought this raw material so I owe its vendor $x.

Insurance is different: An insurance company doesn’t have this clarity. They sell you a policy and have to guess (OK, estimate) what their liabilities for that policy will be: I know that you might have an accident in the car I just insured and that the maximum amount I could owe you on the policy is $1,000,000 but, I don\’t actually owe you that $1,000,000. I can only guess at (OK, estimate) what I might owe, my liability, based on a ton of factors including things like how likely you are to get into an accident, how bad that accident is likely to be, how other parties will be affected, and a gazillion other things. Who do insurers use to predict this liability? Actuaries. So, actuaries were really some of the first data scientists.

And, as some of the links in today’s newsletter show, the insurance business is shifting rapidly. Think about just auto insurance (although there are certainly a huge number of other things that get insured). What will be the impact of self driving cars on this industry? The impact of services like Uber and Lyft? The fact that technologies can now allow insurers to know your driving habits, rather than just guess at them. Changes like these will be huge. Thus, studying what’ going on in insurance could be very instructive for folks in any industry going through technological and societal changes.